If you’re a homeowner in the city of Corning, you received a letter in the mail within the past month regarding the city’s new assessment of your home. This means your property taxes could go up (depending on the local budget – aka Tax Levy), but there’s still time for you to do something about it.

How does the assessment affect me?

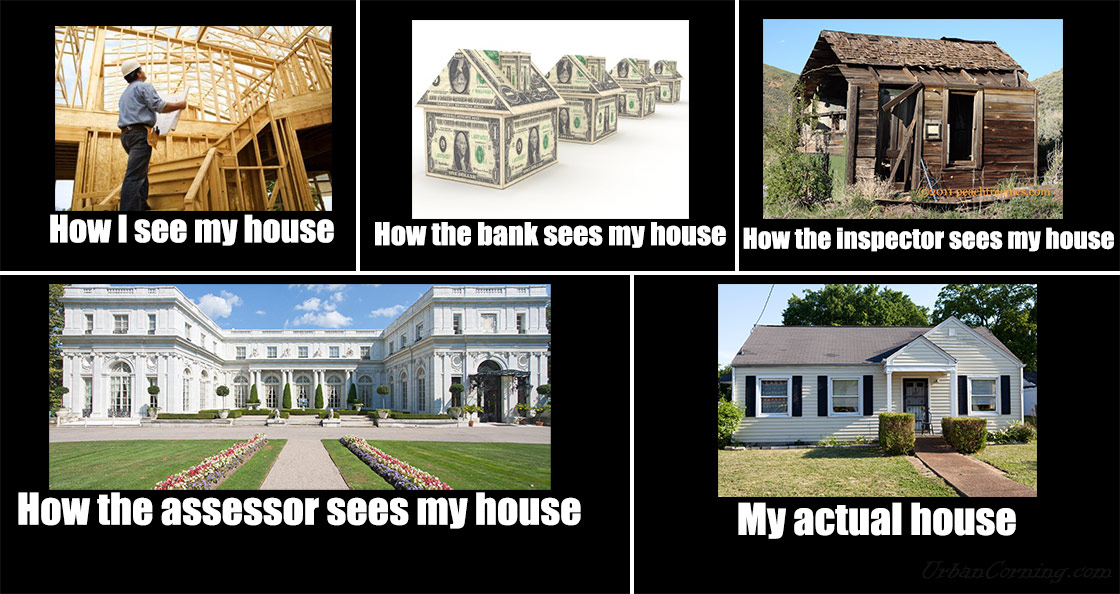

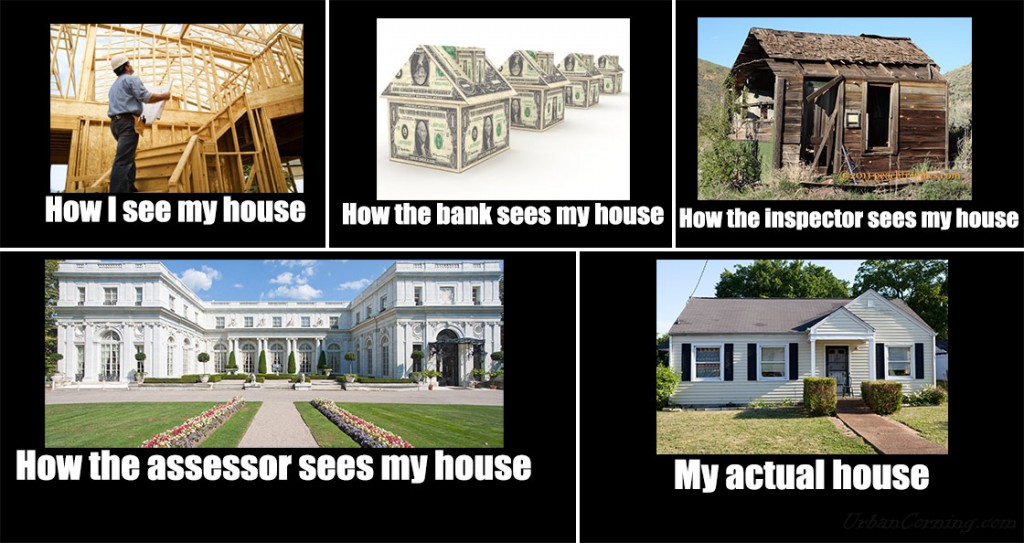

An assessment is the city’s opinion of what your home is worth, so they can tax it accordingly. If you purchased your home recently, your new assessment is likely close to the purchase price. If you’ve lived in your home for a while, the assessment is based on homes that are similar to yours that have recently sold.?

If your home is over-assessed

- Your taxes will be higher than they should be

- When you go to sell your home, buyers may look more favorably on homes that are properly assessed

How do I determine if my assessment is fair?

The best way to do this is to contact a real estate agent (like me). We have resources available to us that make the process faster and more thorough. However, it’s work and we charge for this service. Here’s how to do it on your own:

1) Determine how the city views your home

- Go to the website for?Corning Property Tax Records

- Click the link that reads “Click here for Public Access“

- Search your home address

- If you have trouble searching, a good trick is to use LESS search criteria to get MORE results

- If you see multiple results, simply click the one that is your address

- Click the “Report” button along the left side

- Print out your property report (which includes info you will need below)

2) Find comparable homes

- Click the “Comparables” button along the left side of your property’s tax record

- Scroll to the bottom of the page and click “Run Query“

- Find the 4 most comparable homes (3 is ok) in terms of:

- Neighborhood (or comparable neighborhood if necessary)

- Home style (ranch, 2-story, cape cod)

- Size (sqft, # of beds & baths, and lot size are all factors to consider)

- The more recent the sale date, the better – keep within 1 year

3) Determine if your assessment is higher than the average

- Click the check-box on the far left of each of your four best comparables

- Click “Show selected properties” at the bottom of the page

- Confirm that each property closely compares to your own

- Determine if your tentative assessment is in line with that of your comparable properties

Don’t waste your time trying to rig things in your favor, because it won’t work. However, if your assessment still looks to be excessive,?move on to the next step of the process.

The Review Process | Mail-In Option

Unfortunately I did not have time to write this article before the in-person review process was over (the city gave us a very small window). You can call to check on the availability of late in-person appointments: 1-866-910-1776.

You still have until March 19th, 2014 to do a mail-in review. Do not wait until the last minute!

- Download the Informal Assessment Review:?Download Here

- Fill it out thoroughly using the info you gathered above

- Check for accuracy!

- Send application to:?GAR Associates Inc, 915 Broadway, Albany, NY 12207

- Include photos of anything that may negatively influence the value of your property (interior issues, external forces such as the shack next door, etc…).

- You may also include recent appraisals, or other recent evidence that shows a value lower than their estimate

- TIP: Section, Block, & Lot Number (or S.B.L.) on the Review Application is referring to the TAX ID # (found on the property tax report).

Grievance Day | May 6th

If you were not able to have your assessment reviewed before the March 19th deadline, or you are not satisfied with the results of your review (results are mailed out in April), you want to attend Grievance day. This is your last chance to show evidence that your assessment should be lowered to a specific amount. To attend Grievance day, call 607-962-0340 Ext: 1127. ?Make sure to bring all of the sales comparable information, and any additional evidence to prove your assessment should be lowered.

Additional Tips

- If you completely missed the opportunity to file a review and / or attend Grievance Day, you still have options:

- Informal Assessment Review periods and Grievance day come around yearly between late winter and early spring. These are your best bets to have your case considered seriously. Call for more information on the next available dates: 607-962-0340 Ext: 1127?or send them an email:?[email protected].

- While less likely to work, there is no rule that says you must wait until Grievance Day to object your assessment. Though rare, I have heard of it happening, particularly in extreme cases of improper assessments. Be prepared with research and recent sales comparables to state your case.?Call the assessor’s office at?607-962-0340 Ext: 1127, or send them an email:?[email protected].

- The people who do the assessments have one job and that’s to do a fair value assessment of your home. They don’t control the tax rates, the local budget, etc… ?Don’t waste your time complaining about issues they don’t have control over. Certainly with all the properties, some will fall through the cracks. Be civil, compile your evidence, and present it to them.

Myles started UrbanCorning.com and Facebook.com/UrbanCorning in 2008, and ran it until May of 2014. Myles moved to Tacoma, WA and his new website can be found at: www.tacomatose.com.

Marty Heffner please contact